Average App Opens Increase Post-Pandemic

Average App Opens Increase Post-Pandemic

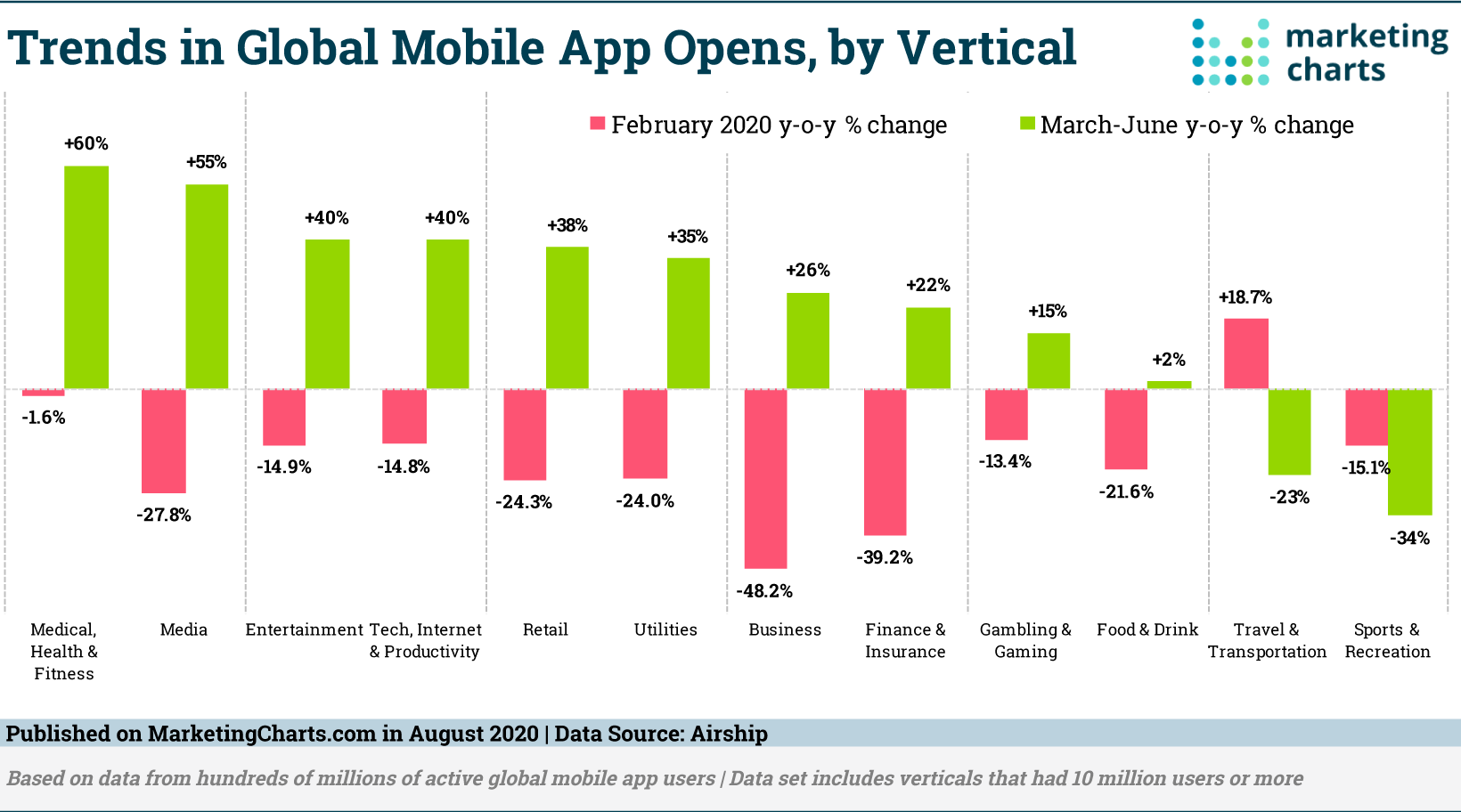

The data from 744 million mobile app users around the world indicates several key trends when comparing year-over-year changes in February 2020 to the pandemic period (March-June). Notably, 11 of the 12 verticals studied saw a decline in average app opens between February 2019 and February 2020, but post-pandemic a similar 10 in 12 verticals saw a significant increase in app opens.

Business apps, which suffered the largest decline in opens y-o-y in February (48.2%), saw a huge turnaround during the March-June period, increasing by 26% year-over-year during these months. Other verticals with similar rebounds include Media, Entertainment, and Retail.

Conversely, despite being the only vertical to experience an increase in app opens y-o-y in February (18.7%), Travel & Transportation apps have understandably taken a hit during the pandemic and have since seen a decline in opens of 23%.

Regionally, average app open trends differ slightly between subregions, with Eastern Asia seeing the biggest y-o-y decline in app opens in February 2020 (-48.9%), while Eastern Europe saw the largest increase in this metric (39.4%).

Direct Notification Open Rates

The study also takes a look at average direct open rate data, that is, app opens from notifications. In February 2020, verticals were evenly split between those seeing y-o-y increases and decreases in average direct open rates. However, over the March-June period, direct open rates grew for 9 in 12 verticals, with the three remaining verticals seeing relatively small declines (Utilities, -2.5%; Travel & Transportation, -7.1%; Entertainment, -16.5%). The increase in direct open rate was as high as 98.4% post-pandemic for Finance & Insurance apps, followed by Food & Drink (71.1%) and Sports & Recreation (46.1%).

Location Opt-In Rates

In yet another post-pandemic trend, location opt-in rates grew in all but three regions (where opt-in rates have been historically low) between March and June, despite 7 in 8 regions having experienced a decrease in this metric between February 2019 and February 2020. In Southern Asia, which saw the biggest y-o-y decrease in February 2020 (-60%), location opt-ins increased by 163% by June. In the US, location opt-ins saw an 18.2% increase between March and June, perhaps indicating Americans are growing more comfortable with sharing location data than they once were.

And, by vertical, Medical, Health & Fitness apps saw the largest change, with their location opt-ins increasing by some 150% between March and June. Even Travel & Transportation apps buck the otherwise-seen trend and experienced an increase in location opt-in rate of 116%.